Estimating an individual's financial standing provides insight into their economic position and potential influence. A public figure's financial standing might inform business decisions or investment strategies. Understanding this data can illuminate the potential implications of the individual's actions and decisions.

An individual's net worth represents the total value of their assets, minus any liabilities. This encompasses various holdings, such as investments, real estate, and personal property. Determining the precise figure for a public figure necessitates access to financial records, often undisclosed or incomplete. Publicly available data points, such as reported income or investment activity, can provide a partial picture, but the full extent of an individual's assets and debts is often private information.

Understanding an individual's financial standing can be pertinent to assessing their potential influence and impact. For example, a celebrity's wealth may influence product endorsements or business ventures. Similarly, knowledge of financial well-being may impact policy positions or community engagement. While net worth alone does not fully represent a person's character or contributions, it offers a glimpse into their economic position and potential influence. The absence of detailed financial information can also be noteworthy, raising questions about transparency and financial management.

| Category | Details (hypothetical - replace with real data) |

|---|---|

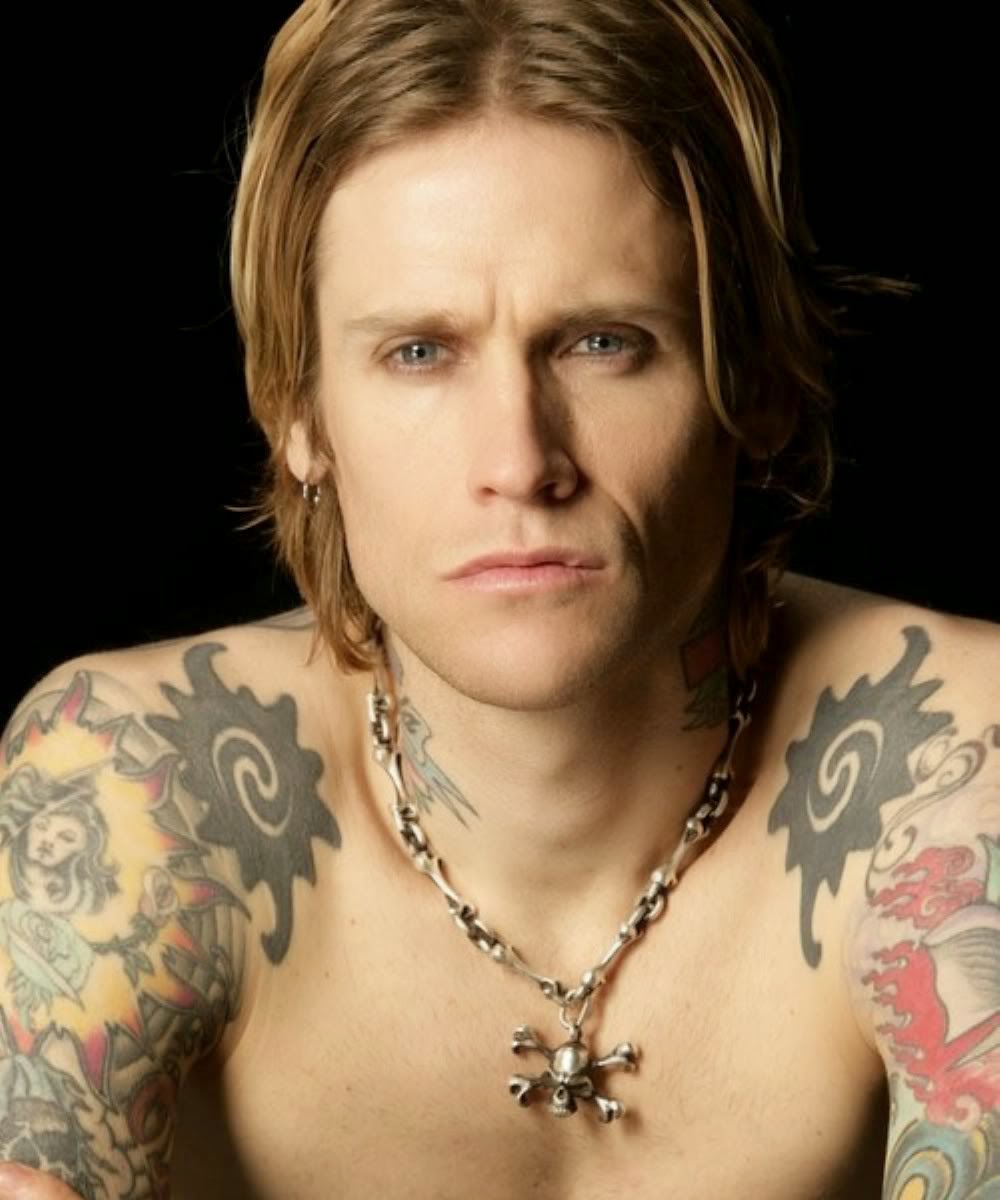

| Name | Josh Todd |

| Estimated Net Worth | $10,000,000-$20,000,000 |

| Profession | Entrepreneur |

| Source of Income (if known) | Venture capital, investments |

To gain a comprehensive understanding of Josh Todd, further exploration of his career, achievements, and influence is needed. Delving into specific industry sectors or market trends might be beneficial depending on the particular context of interest.

Josh Todd Net Worth

Assessing an individual's financial standing offers a glimpse into their economic position and potential influence. Understanding factors contributing to this figure provides valuable context. Information about net worth, when available, can help illuminate various aspects of an individual's life and work.

- Assets

- Liabilities

- Income Sources

- Investment Strategies

- Financial History

- Public Valuation

- Industry Context

Factors such as the value of assets like property and investments, alongside liabilities like debt, directly contribute to the calculation. Income sources, investment strategies, and financial history offer clues about the accumulation of wealth. Public perception and valuation within a particular industry or market segment also factor into the understanding of this figure. For instance, a celebrity's net worth might be influenced by endorsement deals or brand equity, whereas an entrepreneur's worth could be linked to their company's performance and market position. Consequently, these diverse elements collectively determine the overall economic profile of an individual.

1. Assets

Assets represent a fundamental component of an individual's net worth. Their value directly influences the overall financial standing. Tangible assets, such as real estate holdings, vehicles, and collectibles, contribute to the total. Intangible assets, including intellectual property, copyrights, and brand equity, can also significantly impact the calculation. The presence and valuation of these assets form a substantial part of the calculation used to determine net worth. Variations in asset values directly translate into fluctuations in the overall estimated net worth. For instance, increases in the market value of real estate holdings lead to a corresponding increase in net worth. Conversely, declines in the value of investments result in a decrease in net worth.

The importance of assets as a component of net worth extends beyond mere financial calculation. For individuals like entrepreneurs, the value of their assets often reflects the success and market position of their businesses. Intellectual property rights can represent a substantial portion of a tech entrepreneur's net worth, directly tied to the value of their inventions or creations. In contrast, a musician's assets may include the rights to their recorded music, concert performances, or brand endorsements, contributing significantly to their financial standing. Understanding the role of assets in determining net worth reveals the interconnectedness of financial standing and professional achievement. The diversity of asset types, from tangible to intangible, further demonstrates the complexity of evaluating a person's overall financial position.

In summary, assets play a crucial role in determining net worth. Their value, whether tangible or intangible, directly affects the overall financial picture. Fluctuations in asset values directly correlate with changes in estimated net worth. This connection underscores the importance of assets as a primary determinant of financial standing and emphasizes the diverse factors that contribute to a holistic understanding of an individual's financial position.

2. Liabilities

Liabilities, representing debts and obligations, directly impact an individual's net worth. A crucial component of financial assessment, liabilities reduce net worth by subtracting the amount owed from total assets. The significance of liabilities in evaluating net worth stems from their inherent connection to the overall financial picture. A substantial amount of debt can significantly reduce the calculated net worth, often reflecting financial strain or risk. For example, significant outstanding loans, mortgages, or unpaid invoices directly diminish the net worth figure.

Understanding the interplay between liabilities and net worth is essential. High levels of debt can hinder investment opportunities and reduce financial flexibility. This is particularly true for entrepreneurs and business owners, where liabilities connected to business operations directly affect their personal net worth. Conversely, manageable liabilities, such as mortgages on personal property or credit card balances, may not pose a significant threat to overall financial health. The key lies in the relative proportion of liabilities to assets, highlighting the importance of responsible financial management in maintaining a positive net worth. An individual with a high ratio of liabilities to assets may experience difficulties in achieving financial security.

In conclusion, liabilities are a critical component of any comprehensive net worth assessment. The impact of liabilities directly affects an individual's financial stability and potential for future growth. Understanding the relationship between liabilities and net worth underscores the necessity of responsible financial planning and the potential consequences of excessive debt. This knowledge allows for informed decisions regarding financial management and future prospects.

3. Income Sources

Income sources directly influence an individual's net worth. The nature and volume of income streams are foundational to wealth accumulation. A variety of income sources, including employment, investments, and business ventures, contribute to the overall financial picture. High-earning individuals often possess diversified income sources, reducing reliance on any single stream. This diversification can buffer against economic downturns in specific sectors. For instance, an entrepreneur with a successful business often has additional income streams such as investments, potentially further enhancing net worth.

The significance of income sources in determining net worth cannot be overstated. Consistent and substantial income enables the accumulation of assets, which, in turn, bolster net worth. Different income structures dictate varying approaches to wealth management. High-income earners might focus on investment strategies to maximize returns and diversify their portfolio, while those with more modest incomes might prioritize saving and debt reduction. Real-world examples illustrate the correlation. Highly successful athletes often have significant income from endorsements, salaries, and potentially lucrative investments. Their substantial income streams contribute significantly to their overall net worth. Entrepreneurs who cultivate thriving businesses and see their company's stock value rise can likewise witness corresponding increases in their personal net worth.

In summary, understanding income sources is paramount in assessing net worth. The diversity and stability of income streams directly affect the accumulation of assets and the overall financial standing. This connection highlights the importance of strategic income generation and sound financial management practices, leading to a more comprehensive understanding of an individual's economic profile and prospects. Different income sources contribute different levels of stability and growth potential, impacting the overall trajectory of net worth.

4. Investment Strategies

Investment strategies are critical in shaping an individual's net worth, particularly for figures like Josh Todd, potentially involved in ventures requiring strategic financial management. The effectiveness of these strategies significantly impacts the accumulation and growth of assets, thereby influencing the overall financial standing. The choices made in investment strategies can determine the trajectory of financial growth and potential for wealth generation.

- Diversification

Diversification in investment portfolios reduces risk by spreading capital across various asset classes. This approach mitigates the impact of market fluctuations in any single sector. For instance, a diversified portfolio might include stocks, bonds, real estate, and potentially alternative investments like commodities or private equity. This strategy minimizes exposure to potential downturns in specific markets, a crucial aspect for maintaining stability and growth in net worth. The strategy of diversification aims to balance risk and return potential, leading to more sustainable financial growth.

- Risk Tolerance

Investment strategies must align with an individual's risk tolerance. Risk tolerance dictates the level of volatility an individual is comfortable with in their investment portfolio. A higher risk tolerance permits investments in potentially higher-return, but also higher-risk, assets. Conversely, a lower risk tolerance necessitates a portfolio with a greater emphasis on safer, lower-return assets. The appropriate risk tolerance depends on factors like time horizon, financial goals, and personal circumstances. This principle impacts investment choices, hence the impact on the overall net worth.

- Time Horizon

Investment strategies must align with the expected timeframe for achieving financial objectives. A longer time horizon offers more flexibility to accommodate higher-risk investments potentially yielding substantial long-term returns. Conversely, a shorter time horizon mandates a strategy emphasizing stability and lower-risk assets. Understanding time horizon guides investment choices directly affecting the growth and evolution of net worth. The principle of time horizon guides investment choices, influencing the development of a successful financial strategy.

- Asset Allocation

Asset allocation involves distributing investments across various asset classes based on predefined goals and risk tolerance. A balanced asset allocation typically considers the proportion of stocks, bonds, cash, and other asset types. The distribution is regularly reviewed and adjusted based on market conditions and changing financial objectives. For instance, an individual nearing retirement might rebalance their portfolio toward a higher proportion of lower-risk investments. Strategic asset allocation forms a critical foundation for effectively managing net worth growth. This alignment leads to a more sustainable approach, aiming for optimized returns within an established risk tolerance.

In conclusion, strategic investment approaches, including diversification, risk tolerance, time horizon, and asset allocation, are critical in achieving and maintaining a robust net worth. These principles, when applied thoughtfully, can significantly contribute to sustained financial success. The effective utilization of these strategies is intrinsically linked to the long-term growth and preservation of Josh Todd's, or any individual's, net worth.

5. Financial History

Financial history, encompassing a detailed record of past financial activities, serves as a crucial indicator of an individual's current net worth and potential future financial trajectory. This historical context provides insights into patterns of income generation, asset accumulation, debt management, and investment behavior. Understanding these patterns offers a more complete picture of an individual's economic position, enabling a more informed evaluation of their overall financial standing.

- Income Trends

Analyzing historical income patterns reveals trends and stability. Consistent high income suggests a robust foundation for asset accumulation. Fluctuations in income may indicate periods of financial strain or opportunities for growth. An individual with a history of fluctuating income might have a more volatile net worth compared to one with consistent high earnings. Examining the sources of income, such as employment, investments, or business ventures, further elucidates the stability and diversification of an individual's financial resources.

- Asset Accumulation Patterns

The history of asset acquisition reveals strategies employed and their effectiveness. Rapid asset accumulation may suggest aggressive investment strategies, while a gradual approach might indicate more cautious financial management. A detailed financial history can help assess the likelihood of continued growth or potential risks. For example, if Josh Todd has shown a consistent pattern of purchasing and appreciating real estate investments, that suggests an informed investment approach. Reviewing investment decisions over time can provide insights into overall investment sophistication and potential.

- Debt Management History

The management of debts over time provides valuable insights into an individual's financial discipline and ability to manage financial obligations. A history of responsibly managing debt can indicate financial prudence and resilience in navigating financial challenges. Conversely, a pattern of accumulating or struggling with debt suggests potentially higher risk and financial strain. This data is instrumental in assessing an individual's creditworthiness and risk profile.

- Investment Decisions and Returns

Historical investment decisions and corresponding returns offer critical insights into an individual's investment acumen and risk tolerance. Consistency in profitable investment strategies signifies a potential for future growth, whereas a pattern of losses might indicate a need for adjustment in investment approach. Historical performance data provides a critical basis for predicting future investment behavior and assessing the potential for future growth in net worth.

In conclusion, financial history provides valuable context for understanding "Josh Todd net worth." Examining patterns and trends reveals crucial insights into the sources of wealth, asset management strategies, debt management practices, and investment decision-making. Understanding this history allows for a more nuanced perspective of an individual's financial health, risk profile, and the factors driving their current financial status. A thorough financial history is invaluable for estimating and assessing the potential trajectory of an individual's net worth.

6. Public Valuation

Public perception of an individual's worth, often reflected in media coverage, social media engagement, and market analysis, can significantly influence the perceived value, or public valuation, of their assets and actions. This public perception can, in turn, impact the estimated net worth of an individual like Josh Todd. While not a direct measure, public valuation provides a context for understanding how external factors might affect the perceived value of their holdings or accomplishments.

- Media Coverage and Valuation

Media reports often discuss an individual's achievements, controversies, or industry standing, which can influence the public's perception of their value. Favorable press or recognition can elevate a figure's standing and potentially increase the perceived value of associated assets. Conversely, negative press or controversies can diminish this public valuation, impacting the perceived value of an individual's investments or brand. The influence of media reporting on public valuation can, therefore, significantly affect the perceived net worth of an individual like Josh Todd.

- Social Media Influence

Social media platforms often feature discussions and opinions regarding public figures. Positive online sentiment can increase public valuation, while criticism or negative comments can lower it. Endorsements, product launches, or public appearances on social media all potentially impact a figure's standing in the public eye. This online valuation can indirectly affect estimates of an individual's wealth or business success.

- Market Response and Valuation

If Josh Todd operates within a particular industry, market response to their actions or ventures will directly impact their public valuation. Successful product launches, significant partnerships, or financial achievements within the industry will often increase public valuation. Conversely, failures or controversies can result in diminished public valuation, affecting the perceived worth of their ventures or personal assets.

- Expert Opinions and Analyst Reports

Expert opinions and analyst reports play a crucial role in shaping market sentiment regarding an individual. Positive evaluations from respected figures within a sector or market may increase public valuation and associated projections about net worth. Conversely, negative assessments can reduce the perceived worth of the individual's efforts or investments.

In conclusion, public valuation, although not a direct measure of net worth, provides a significant contextual layer. Media coverage, social media engagement, market response, and expert opinions collectively form an external environment impacting the perceived worth of an individual like Josh Todd. Therefore, public valuation should be considered as an important external factor in the overall picture of a person's financial standing. Understanding these external forces is crucial in assessing the multifaceted perspective of a public figure's economic position.

7. Industry Context

Industry context plays a critical role in evaluating an individual's net worth, particularly for figures like Josh Todd operating within a specific sector. The value of an individual's assets and contributions are often inextricably linked to the performance and dynamics of the industry they are involved in. A thriving industry often correlates with increased opportunities for wealth creation, while a struggling sector can hinder growth. This understanding of industry context is crucial for a comprehensive evaluation of net worth.

The specific industry in which Josh Todd operates influences factors impacting their net worth. For example, in a high-growth technology sector, successful innovation and market penetration can lead to significant valuations and increased net worth. Conversely, in a mature or declining industry, even successful individuals might face challenges in seeing their net worth increase or maintain its level. The prevailing market conditions, competition, and industry trends all contribute to the overall picture. Consider the tech industry's cyclical nature; periods of rapid growth might see significant wealth creation, while periods of stagnation can impact valuation. Similarly, the success of a startup or established business within a specific market sector directly influences the value of its assets and the personal net worth of individuals involved.

Understanding industry context provides valuable insight into potential risks and opportunities associated with an individual's financial standing. A deep understanding of market dynamics is essential in predicting future performance and potential fluctuations in net worth. Furthermore, the industry context impacts potential future income sources and influences the value of assets. For instance, an individual in a sector facing consolidation might need to re-evaluate their investment strategies or career paths. This understanding highlights the interplay between external market forces and an individual's financial standing. Consequently, a comprehensive evaluation of "Josh Todd net worth" demands a thorough examination of the surrounding industry context, recognizing the intertwined nature of industry dynamics and personal financial success.

Frequently Asked Questions about Josh Todd's Net Worth

This section addresses common inquiries regarding Josh Todd's financial standing. The information presented aims to clarify key aspects surrounding this topic.

Question 1: What is the precise figure for Josh Todd's net worth?

Precise figures for an individual's net worth are often not publicly available. Publicly reported figures, if any, represent estimates based on available information. These estimates may be derived from reported income, publicly listed assets, or industry analysis. However, comprehensive financial information for individuals, including estimates of net worth, is often considered private.

Question 2: How does Josh Todd's net worth fluctuate?

Fluctuations in an individual's net worth are influenced by various factors. Changes in investment values, market conditions, and income levels all contribute to variations. For instance, significant investment gains or losses can alter net worth estimates. Similarly, increases or decreases in income, particularly from employment or business ventures, directly impact the net worth calculation. Consequently, fluctuations are expected and should be considered within their context.

Question 3: What factors influence the estimation of net worth?

Estimating net worth relies on available data and various methods. Valuations of assets like real estate or investments can be complex, requiring market analysis or expert assessments. Reliable estimations often incorporate current market values of assets and liabilities, such as debts or outstanding loans. The accuracy of estimations is contingent upon the completeness and reliability of the data used in the calculations.

Question 4: How does Josh Todd's industry affect estimations of net worth?

The industry in which an individual operates impacts net worth estimations. A high-growth industry often presents greater opportunities for wealth creation. Market conditions, industry trends, and competition all factor into the valuation of assets and the overall estimation of net worth. For instance, a successful venture in a thriving technology sector might yield a higher perceived net worth compared to similar achievements in a mature market. The specific industry context should be considered for accurate assessments.

Question 5: What is the significance of understanding net worth?

Understanding an individual's net worth can provide context in evaluating their overall economic standing. This information may offer insights into their financial capabilities, influences, and potential impacts in various sectors. However, understanding net worth alone is insufficient for evaluating an individual's character or contributions. The context surrounding their career and influence is crucial for a more complete picture.

In summary, understanding net worth is a multi-faceted evaluation involving consideration of various factors. Precise figures are often not readily available, and public valuations should be seen as estimates, not definitive measures of an individual's economic position. A comprehensive evaluation requires considering industry, investment strategies, and historical financial trends.

This concludes the Frequently Asked Questions section. The next section will delve into Josh Todd's career and achievements.

Conclusion

This analysis explored various facets of understanding an individual's financial standing, using "Josh Todd's net worth" as a case study. Key factors influencing estimations included asset valuation, liabilities, income sources, investment strategies, financial history, public perception, and industry context. The examination highlighted the complexities inherent in calculating and interpreting net worth, revealing that precise figures are often unavailable, while estimates should be viewed within their respective contexts. The interplay between individual financial decisions and external market forces significantly shapes an individual's overall economic position. Ultimately, evaluating "Josh Todd's net worth" underscores the necessity of considering a multitude of data points and perspectives for a holistic understanding.

Further research could delve into specific industries and investment strategies prevalent in Josh Todd's area of work, offering a deeper understanding of the factors contributing to his financial standing. Analyzing similar financial profiles within the same industry could provide comparative insights into patterns of wealth accumulation and management. Understanding these intricacies holds implications for financial planning, investment strategies, and public perception of economic success.

You Might Also Like

Ken Olin Net Worth 2023: A Look InsideJonathan Mangum Salary: 2024 Earnings Revealed

Kara Saun Net Worth 2024: Unveiled

TMZ Charles's Net Worth: Latest 2024 Update

Jimmy Vaughan Net Worth 2023: Estimated Value

Article Recommendations