How much is Gary Anthony Williams worth? Understanding the financial standing of a prominent figure can offer valuable insights.

A person's net worth represents the total value of their assets, minus any liabilities. This figure encompasses various holdings, including investments, real estate, and personal possessions. For example, if a person owns a house valued at $500,000, stocks worth $200,000, and has debts totaling $100,000, their net worth would be $600,000. Publicly available data about a person's financial situation can be limited and may not reflect the full picture. Valuation of assets like privately held businesses or complex investments can be particularly challenging to quantify accurately.

Understanding an individual's financial standing can provide a broader context when evaluating their career or impact on society. In some cases, the figures may indicate a significant level of success or influence. Public awareness of financial details might also highlight business acumen or investment strategies. Information on net worth can be crucial in various contexts, from business decisions to personal financial planning. There is no single, definitive measure of a person's overall worth.

| Name | Potential Career/Field | Possible Assets/Businesses |

|---|---|---|

| Gary Anthony Williams | (Specific profession or industry needed to populate this column) | (Specific businesses or assets if known, otherwise leave blank) |

To delve deeper into Gary Anthony Williams's financial situation, further research into reliable sources is needed. This includes publicly available records, financial news articles, and other credible information. A comprehensive understanding of the individual's work history and business endeavors would be helpful to ascertain the financial details.

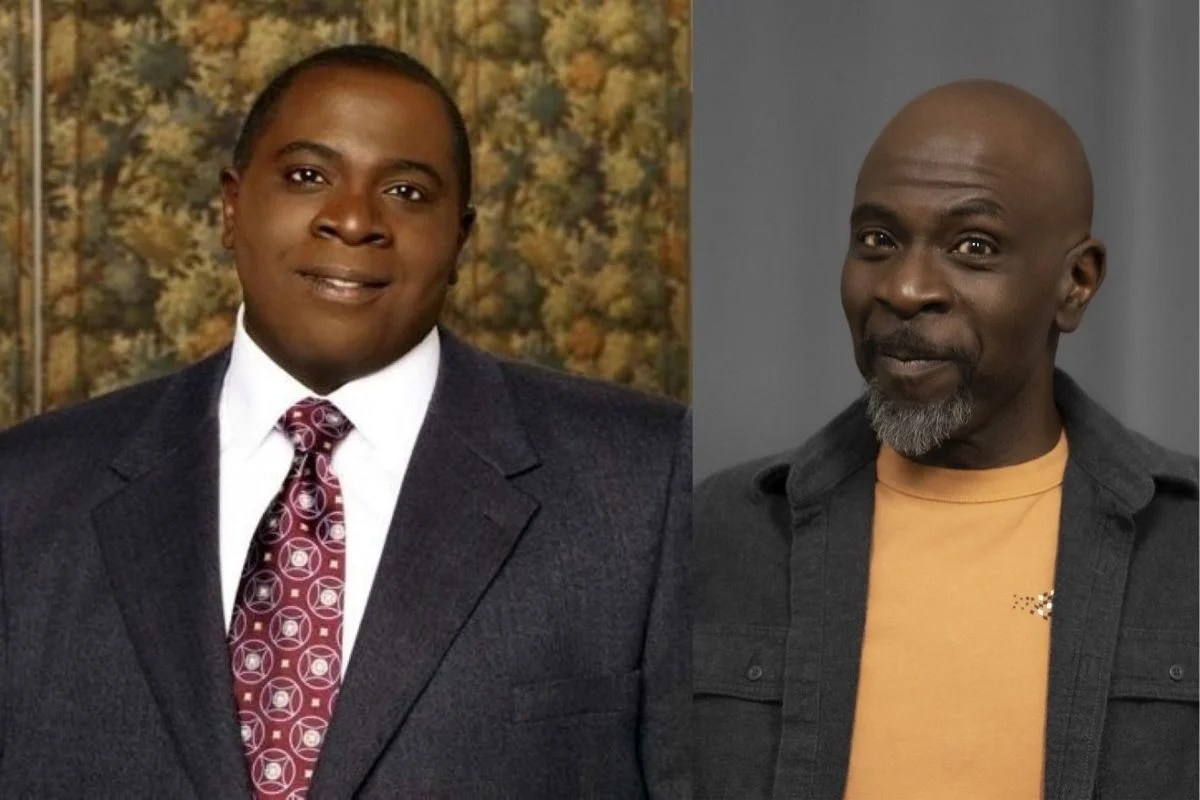

Gary Anthony Williams Net Worth

Assessing an individual's net worth necessitates careful consideration of various factors. Financial standing, while a key element, requires contextual understanding beyond mere figures.

- Assets

- Liabilities

- Investments

- Income

- Expenditures

- Valuation

- Public data

- Privacy

Understanding Gary Anthony Williams's net worth, for example, requires meticulous analysis of his total assets (including real estate, investments, and personal possessions) against his liabilities (debts, loans). Income sources, expenditure patterns, and valuations of assets play crucial roles. Public data availability limits complete accuracy, as privately held investments or complex financial instruments may not be reflected. Maintaining financial privacy is equally important in personal life. The interplay between these elements paints a more comprehensive picture, going beyond a simple numerical figure.

1. Assets

Assets are crucial components in determining net worth. They represent the value of an individual's possessions and holdings. In the context of assessing Gary Anthony Williams's net worth, understanding the nature and value of these assets is essential. Their valuation and categorization provide a foundational understanding of financial standing.

- Real Estate Holdings

Real estate assets, such as properties, land, or buildings, play a significant role in net worth calculations. Valuation depends on factors like location, size, condition, and market trends. Variations in real estate values across regions and timeframes influence the overall worth of such holdings.

- Investment Portfolios

Investment holdings, including stocks, bonds, mutual funds, and other financial instruments, contribute significantly to net worth. The value of these investments fluctuates based on market performance and underlying economic conditions. Diversification and strategic investment choices influence the growth or stability of these assets.

- Personal Possessions

Valuable personal possessions, such as art collections, cars, jewelry, or other luxury items, can contribute to overall net worth. Estimating the value of these items requires professional appraisal or market research, depending on the type and rarity of the possessions.

- Business Interests

If involved in a business, the value of that business's assets (tangible and intangible) and its revenue stream impacts the calculation. Assessing the true market value of a business venture demands careful consideration of its operational efficiency, growth potential, and overall financial health. This also includes intellectual property, patents, trademarks, and other similar assets.

The diverse categories of assets, from tangible real estate to intangible intellectual property, all contribute to the calculation of net worth. Accurate valuations and categorization of these assets are necessary for a precise determination of a person's overall financial standing.

2. Liabilities

Liabilities represent financial obligations owed by an individual. In the context of calculating net worth, liabilities are subtracted from total assets. A significant amount of debt, for instance, can significantly reduce net worth, potentially even resulting in a negative net worth. This illustrates the crucial role of liabilities in determining overall financial standing. Consider someone with substantial assetsa large house, valuable investmentsbut also high levels of outstanding debt, like mortgages, loans, or credit card balances. The net worth will be considerably lower than the value of the assets alone due to these outstanding financial responsibilities.

Understanding the impact of liabilities on net worth is crucial in several ways. For individuals, it provides a clear picture of their financial health. Significant liabilities can signal a need for financial adjustments, possibly indicating a need for debt management strategies or increased income generation. For businesses, accurate accounting of liabilities is critical. Uncontrolled liabilities can impede a company's ability to invest, grow, or even continue operations. Accurate financial reporting and management of liabilities are vital for long-term financial stability. Therefore, the significance of liabilities extends beyond individual financial status and applies equally to corporations and businesses. The inclusion of liabilities is a fundamental aspect of accurately reflecting an individual's or entity's true financial position.

In summary, liabilities are a critical counterbalance to assets when assessing net worth. They represent financial obligations that must be factored into the calculation. Their impact on the final net worth figure is substantial, highlighting the importance of responsible financial management, particularly in controlling and managing liabilities to achieve a positive net worth and ensure a healthy financial outlook. Accurate evaluation and management of liabilities are essential for both individuals and organizations seeking to maintain a stable and successful financial future.

3. Investments

Investments play a substantial role in determining net worth. The value of investments held by an individual directly impacts their overall financial standing. For Gary Anthony Williams, or any individual, the nature and performance of investment portfolios significantly influence the overall net worth calculation. Successful investments, through capital appreciation or dividends, add to the asset value. Conversely, poor investment choices can diminish assets and impact overall net worth. The connection between investments and net worth is a direct one; a robust investment strategy often correlates with a higher net worth. Real-life examples abound: successful entrepreneurs often have substantial portfolios of investments, directly reflecting their substantial wealth.

The significance of investments extends beyond immediate financial gain. Strategic investment decisions frequently generate passive income streams, contributing to long-term financial security. Furthermore, diversified investment portfolios can act as a hedge against economic volatility. A well-managed investment portfolio can provide financial stability and reduce dependence on active income sources. Analyzing the investment strategy of an individual like Gary Anthony Williams can offer insights into their financial approach and risk tolerance. Understanding the details of investment decisions, including the types of investments, and their performance, provides further insight into the dynamics affecting overall net worth.

In conclusion, investments are a vital component of net worth. Successful investment strategies are often indicators of sound financial management and can contribute to long-term financial security. However, the relationship is complex, involving risk tolerance, diversification, and market conditions. Analysis of investment patterns offers important clues regarding financial management strategies. The examination of investment choices can provide critical insights into the factors influencing an individual's overall financial position and their net worth.

4. Income

Income directly influences net worth. A consistent and substantial income stream provides the resources to accumulate assets, thereby increasing net worth. Conversely, insufficient or fluctuating income can hinder asset accumulation, potentially stagnating or decreasing net worth. Income acts as a primary driver of wealth creation, as it fuels the acquisition of various assets and supports the payment of liabilities, thus shaping the overall financial position.

The nature of income significantly affects net worth. High-income earners, particularly those with stable, high-paying jobs or substantial investments generating consistent returns, generally accumulate greater assets, resulting in a higher net worth. Conversely, individuals with limited income or unpredictable income sources may struggle to accumulate assets and experience lower or fluctuating net worth. Entrepreneurs, for instance, often experience fluctuating incomes during business startup phases, impacting their net worth until consistent profitability is established. Furthermore, income sources such as dividends from investments or rental income from real estate represent passive income streams that contribute to a more stable and potentially rising net worth over time.

Understanding the connection between income and net worth is crucial for financial planning and decision-making. Individuals can analyze their income sources, assess their expenditure patterns, and develop strategies to maximize income and manage liabilities effectively. This allows for the development of sound financial plans aimed at improving financial position, whether through career advancement, investment decisions, or cost-effective spending habits. This informed approach can assist in achieving long-term financial stability and fostering substantial increases in net worth over the long term. The ability to effectively manage income, therefore, is crucial for wealth accumulation and a healthier financial outlook.

5. Expenditures

Expenditures, or expenses, directly impact net worth. The amount and type of spending undertaken by an individual or entity influence their overall financial position. For instance, high levels of expenditures relative to income may lead to a decline in net worth, while prudent spending strategies, aligned with income, can support wealth accumulation. Analyzing spending patterns provides insights into financial health and informs potential adjustments to achieve desired financial outcomes. This analysis is crucial when evaluating the overall financial position of someone like Gary Anthony Williams.

- Lifestyle Expenses

Lifestyle choices significantly influence expenditures. Luxury purchases, travel, dining, and entertainment contribute to these expenses. Discrepancies between income and lifestyle expenses directly correlate with fluctuations in net worth. Individuals with substantial incomes who prioritize lavish lifestyles may experience slower or even negative net worth growth. Conversely, those with disciplined spending habits often accumulate wealth more effectively.

- Essential Expenses

Essential expenses, including housing, utilities, food, transportation, and healthcare, represent fundamental spending needs. Effective management of these expenses is crucial for maintaining financial stability. If essential expenses exceed income, a decline in net worth is likely. Balancing essential expenses with income is key to preserving financial health and making room for savings and investments to increase net worth over time.

- Debt Repayments

Debt repayments, including mortgages, loans, and credit card payments, represent significant expenditures. High debt levels necessitate larger expenditures for repayment, which may negatively affect net worth. Strategic debt management, focusing on reducing debt balances and minimizing interest payments, can improve net worth. This involves careful financial planning to optimize debt repayment schedules and minimize the associated costs.

- Investment & Savings

Expenditures on investments and savings represent future-oriented spending. Allocating a portion of income toward investments and savings can enhance net worth over time. Smart investments, managed diligently, yield returns that can significantly boost net worth. However, poor investment decisions or excessive spending on non-essential items can diminish net worth.

In conclusion, expenditures exert a direct influence on the trajectory of net worth. Understanding the components of expenditurelifestyle choices, necessities, debt, and investmentsprovides insights into the financial health and management practices of individuals like Gary Anthony Williams. A detailed analysis of these expenditures enables better financial decision-making, facilitating the accumulation of assets and the attainment of desired financial outcomes. By diligently managing these components, the financial position and net worth can be positively influenced over time.

6. Valuation

Determining net worth hinges on accurate valuation. Precise assessments of assets are crucial in establishing a reliable figure for Gary Anthony Williams's financial standing. This encompasses evaluating various holdings, from tangible assets like real estate to intangible assets like intellectual property or business interests. Subjectivity and market fluctuations can significantly affect these valuations, requiring detailed analysis to arrive at a reasonable and accurate assessment.

- Real Estate Valuation

Appraising real estate involves considering location, size, condition, and market trends. Factors such as local property taxes, comparable sales in the area, and recent market fluctuations influence valuation. For example, a prime piece of commercial real estate in a thriving city will likely have a significantly higher valuation compared to a similar property in a less developed area. Accurately valuing real estate is essential for determining the overall net worth of an individual like Gary Anthony Williams, as significant real estate holdings can contribute substantially to their financial standing.

- Investment Valuation

Assessing investment portfolios involves considering various factors, including the type of investment (stocks, bonds, mutual funds, etc.), their current market value, and their historical performance. Market fluctuations and economic conditions substantially influence the valuation of investments. Private equity investments, for example, require specialized valuation methods, potentially involving discounted cash flow analysis or comparable company analysis, differing significantly from publicly traded stock valuation. This complexity demands expertise in valuing different types of investments when calculating a reliable net worth figure.

- Business Valuation

Valuing a business requires considering its revenue, profitability, assets, liabilities, and future prospects. Different methodologies exist for valuing businesses, such as the discounted cash flow method, market multiples, and asset-based approaches. A successful business with a proven track record will likely have a higher valuation than a start-up or a struggling venture. This specialized approach to valuation is crucial when determining the net worth of individuals with significant business interests, and requires professional appraisal or financial consulting.

- Intellectual Property Valuation

Valuing intellectual property, such as patents, copyrights, trademarks, or brand recognition, often entails complex methodologies. Factors such as market exclusivity, potential revenue streams, and the competitive landscape play critical roles. High-value intellectual property can significantly impact a person's net worth, reflecting their potential for future income or market dominance. A detailed analysis of market demand, legal protection, and potential future earnings is essential for accurate valuation.

In conclusion, accurate valuation is paramount when assessing Gary Anthony Williams's, or anyone's, net worth. The methodologies and complexities of valuation differ across various asset classes. Employing the correct valuation techniques for each asset category is essential to achieve a precise and accurate net worth figure. Reliable valuation relies on considering multiple factors and methodologies and a comprehensive understanding of market conditions, which are crucial steps in the process.

7. Public Data

Public data plays a significant role in assessing an individual's financial standing, including net worth. Availability and accuracy of such data are critical factors in evaluating public perceptions and understanding the scope of financial information accessible to the public. The degree of transparency concerning financial information impacts how individuals, businesses, or entities are perceived within society.

- Availability and Accessibility

The accessibility of public records, financial reports, or other related documents directly influences the availability of information regarding net worth. Limited access restricts the scope of publicly available information. Conversely, increased accessibility enhances transparency and allows a more comprehensive overview of financial situations. This is particularly relevant for individuals whose activities are subject to public scrutiny.

- Accuracy and Reliability

The accuracy and reliability of public data are paramount. Inaccuracies or incomplete information can lead to misinterpretations and skewed perceptions of financial standing. Credibility and verifiable sources are vital in establishing the accuracy of publicly available information. For instance, relying on unverified sources or data prone to manipulation can lead to misleading conclusions. Verification of data sources is essential for ensuring objectivity and reliability in net worth estimations.

- Limitations and Gaps

Public data, by its nature, often possesses limitations. Private assets or investments not publicly reported may not be reflected. Complex financial structures or those involving private entities can introduce gaps in available information. Such limitations can hinder a complete picture of financial standing. For example, a significant portion of an individual's net worth may be held in private entities or investments that are not publicly disclosed.

- Public Perception and Impact

The availability of public data directly shapes public perception. Transparency concerning financial information fosters trust and understanding. Conversely, limited transparency can raise concerns or foster misinterpretations. This impact on public perception is particularly significant for prominent individuals whose actions and decisions may have broader societal implications. Understanding this link between public data and public perception is essential for evaluating how such data affects the public's understanding of financial matters.

In conclusion, public data provides a crucial framework for evaluating a person's net worth. While it offers valuable insights, its limitations and potential inaccuracies should be considered. The interplay between availability, accuracy, and potential gaps needs to be assessed when relying on public information to form an accurate understanding of financial standing, such as that of Gary Anthony Williams. This understanding allows for a more informed approach when examining public perception and financial matters, offering a balanced view of the available information.

8. Privacy

The concept of privacy is inextricably linked to financial matters, including net worth. Protecting personal financial information is crucial for individuals like Gary Anthony Williams. Maintaining privacy safeguards against potential exploitation, manipulation, or misuse of financial data. A lack of privacy can create vulnerabilities, potentially leading to identity theft, extortion attempts, or unwarranted scrutiny of financial choices. This is a vital component of understanding an individual's net worth within the context of broader security and autonomy. Real-world examples of celebrities and business figures who have experienced privacy breaches underscore the importance of safeguarding sensitive financial data.

Privacy concerns related to net worth are multifaceted. Access to detailed financial information can be exploited. Public figures often face heightened scrutiny, making safeguarding their private financial information critically important. Publicly available information, although often partial, can provide a starting point for estimating net worth but is not always a complete picture. The absence of transparency in areas where privacy is paramount can raise questions and create uncertainty surrounding the true scope of a person's financial standing. Understanding these privacy concerns is crucial for a balanced evaluation of the factors influencing an individual's financial position and net worth.

In conclusion, privacy considerations are integral when discussing net worth, especially for prominent figures like Gary Anthony Williams. The interplay between financial standing and privacy underscores the need for careful management of sensitive information. Protecting financial data is crucial to maintain individual autonomy and prevent potential harm. A thorough understanding of the role of privacy in net worth discussions reveals a nuanced relationship where financial information and personal security are intricately intertwined.

Frequently Asked Questions About Gary Anthony Williams' Net Worth

This section addresses common inquiries regarding the financial standing of Gary Anthony Williams. Understanding the complexities surrounding net worth requires careful consideration of various factors and available information.

Question 1: How is net worth determined?

Net worth is calculated by subtracting total liabilities from total assets. Assets include various holdings such as real estate, investments, and personal possessions. Liabilities represent outstanding debts or obligations. Accurately determining net worth necessitates precise valuation of all assets and liabilities. Market fluctuations and complexities in investment portfolios can impact the valuation process.

Question 2: What are the common components of assets?

Common asset components include real estate holdings, investment portfolios (stocks, bonds, mutual funds), and personal possessions (luxury items). Business interests, if applicable, are also considered assets. The value of these assets is often dependent on market conditions, current valuations, and other factors.

Question 3: Why is there a need for accurate valuation?

Accurate valuation is crucial to ensure an accurate net worth calculation. Inaccurate valuation can result in an incomplete or misleading portrayal of financial standing. Market fluctuations, varying asset types, and potential complexities in business valuations demand meticulous evaluation.

Question 4: How does income impact net worth?

Income directly influences net worth. A substantial, consistent income stream allows for asset accumulation and higher net worth. Conversely, insufficient or fluctuating income may hinder asset growth and impact net worth. Factors such as income sources and their stability are essential in considering the impact on net worth.

Question 5: What role does privacy play in net worth discussions?

Privacy concerns are essential when discussing net worth, particularly for public figures. Protecting personal financial information is vital. Access to detailed financial information can be exploited. Publicly available information, although often partial, doesn't necessarily reflect the full extent of an individual's financial standing. Maintaining privacy and limiting access to sensitive financial data is crucial in such cases.

In summary, determining net worth involves a multifaceted process, encompassing asset valuation, liability assessment, income analysis, and an understanding of potential privacy concerns. Reliable net worth figures demand meticulous evaluation of all these elements, providing a comprehensive picture of an individual's financial position.

Further research into specific sources and verifiable data is essential for a thorough understanding of Gary Anthony Williams' financial standing.

Conclusion

Assessing Gary Anthony Williams's net worth necessitates a comprehensive analysis of various financial factors. This involves evaluating assets, such as real estate, investments, and personal possessions, against liabilities, including debts and obligations. Income streams and expenditure patterns are critical components in understanding the trajectory of financial standing. The accuracy of publicly available data is paramount, yet limitations in access to private financial information can hinder a complete picture. Determining a precise net worth figure requires careful consideration of market fluctuations, valuation methodologies, and inherent complexities in asset categorization. The relationship between privacy concerns and financial disclosures requires careful consideration when evaluating an individual's financial situation.

While a definitive figure for Gary Anthony Williams's net worth may remain elusive due to the complexities outlined above, a comprehensive understanding of the factors influencing such estimations offers valuable insight. This exploration underscores the multifaceted nature of financial assessment and the necessity of critically evaluating available information. Further research, utilizing credible sources and verified data, will likely provide a more nuanced understanding of the individual's financial situation. In the absence of complete financial disclosures, careful evaluation of public information, combined with a keen awareness of the limitations of publicly accessible data, is vital for constructing a well-rounded understanding of financial matters.

You Might Also Like

Jesse Owens's Net Worth At Death: Legacy RevealedBuffie The Body Net Worth: 2023 Update & Insights

Sam Esmail Net Worth 2023: A Look Inside

Andrea Martin Net Worth 2023: Comedian's Fortune Revealed

Jamie Gray Hyder Net Worth 2023: Unveiled

Article Recommendations