Estimating a person's financial standing can offer insights into their career trajectory and overall success. This individual's accumulated wealth is often a subject of public interest, particularly within the realm of entrepreneurship and high-profile professions.

An individual's net worth represents the total value of their assets, minus their liabilities. Assets encompass items of economic value, such as real estate, investments, and personal possessions. Liabilities include debts, such as loans and outstanding payments. Calculating net worth provides a snapshot of an individual's financial health at a specific point in time. For example, if someone owns a house valued at $500,000 and has a mortgage of $200,000, and other assets and liabilities, their net worth would be the difference between these figures, along with other assets and liabilities.

Understanding an individual's financial standing can offer various insights. For instance, it can provide a sense of a person's career success, particularly in fields like business and finance. Furthermore, a person's wealth is often seen as a reflection of their professional achievements. The public's interest in financial details often stems from a general curiosity about the economic success stories of individuals in various professions.

Unfortunately, without specific disclosure, a precise figure for the net worth of an individual cannot be provided. Public information sources often do not provide detailed personal financial data of individuals.

To delve into the details of this person's background, career, and contributions, further research will be necessary. The focus now shifts to exploring details pertaining to this individual's public life.

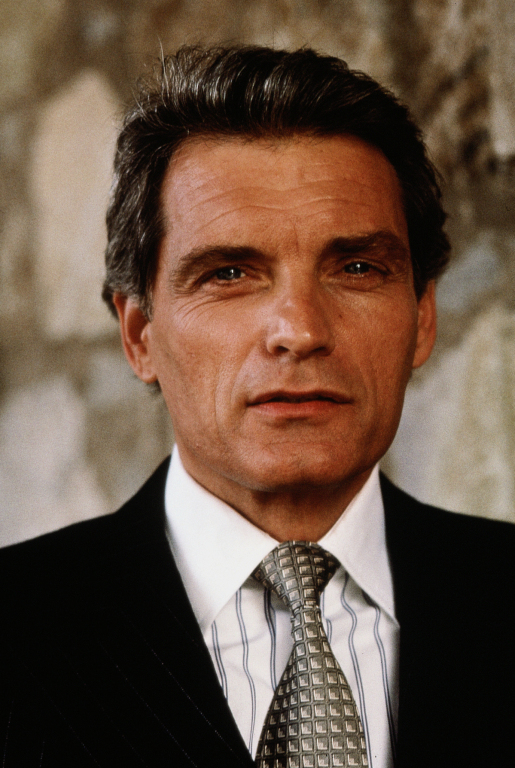

David Selby Net Worth

Assessing an individual's financial standing, like David Selby's, provides insight into their career success and overall financial position.

- Financial data

- Public information

- Asset valuation

- Investment history

- Income sources

- Professional success

- Net worth calculation

Information on David Selby's net worth is often derived from publicly available sources, such as financial reports and industry publications. Asset valuation, investment decisions, and income sources play crucial roles in determining a figure. Professional success, often correlated with significant income, can also impact net worth. Calculating net worth involves complex processes incorporating asset value and liabilities, potentially highlighting the significance of various elements of David Selby's career, particularly within his professional field.

1. Financial Data

Financial data is essential for determining an individual's net worth. Understanding this data provides context for evaluating the financial standing of an individual, like David Selby, within their professional field and overall economic position. Accurate financial data, meticulously compiled and analyzed, is fundamental to such estimations. Without access to this kind of data, assessing net worth becomes speculative and unreliable.

- Income Sources

Identifying the sources of income is a critical component of evaluating net worth. For David Selby, or any individual, income from various sources such as employment, investments, and ventures plays a key role. Analysis of the nature and volume of these sources provides insights into the individual's financial health and stability.

- Asset Valuation

Accurate assessment of assets is crucial. This involves quantifying the value of possessions like property, investments (stocks, bonds, etc.), and other holdings. The valuation process must consider market conditions and the specific characteristics of each asset for accurate reflection of their worth.

- Liability Assessment

Evaluating liabilities, such as debts and outstanding obligations, is equally important. Accurate accounting of liabilities allows for precise calculation of net worth by subtracting them from the total value of assets. This process allows for a comprehensive view of the individual's financial position.

- Investment History

Examining the history of investments provides insights into financial strategies and potential returns. Investment patterns can reflect the individual's risk tolerance and financial acumen. A review of investment performance offers a deeper understanding of past decisions and possible future implications for net worth.

In summary, comprehensive financial data, covering income, assets, liabilities, and investment history, is necessary to evaluate an individual's net worth accurately. For individuals in the public eye, like David Selby, access to such data is often limited, making comprehensive assessment challenging. However, the factors described above provide a structure for evaluating the potential components of David Selby's net worth based on publicly available information.

2. Public Information

Public information plays a significant role in estimating an individual's net worth, such as David Selby's. This data, often gleaned from publicly accessible sources, provides a basis for calculating an individual's financial standing. The availability and reliability of such information are crucial for assessments, although direct financial disclosures are frequently unavailable.

Public records, including financial filings, property records, and news reports, offer various pieces of the financial puzzle. For instance, information about real estate holdings, corporate investments, or significant financial transactions reported in media can be valuable indicators. However, this information is often incomplete or requires careful analysis to avoid misinterpretations. A key consideration is the potential for inaccuracies and omissions, particularly in cases where financial disclosures are not mandatory or when the data is indirectly derived. This underscores the importance of considering publicly available information in conjunction with other potentially reliable sources.

Ultimately, public information serves as a starting point for exploring an individual's net worth. While it may not provide a precise figure, it can illuminate patterns, highlight potential sources of wealth, and offer clues into the overall financial standing. The availability of such information is critical for public understanding of an individual's economic position, yet its interpretation requires cautious consideration to prevent drawing inaccurate conclusions based on incomplete or potentially misleading data. Access to detailed financial records is crucial, but often lacks availability due to privacy concerns, potentially limiting the comprehensive evaluation of a person's net worth based solely on publicly available information.

3. Asset Valuation

Asset valuation is a crucial component in determining net worth, particularly for individuals like David Selby. Accurate valuation of assets forms the bedrock of any net worth calculation. A precise assessment of holdings, including real estate, investments, and personal property, directly impacts the calculated net worth. Fluctuations in market values for investments, for example, directly affect the total asset value and consequently, the net worth figure.

Consider the example of real estate holdings. If the market value of a property owned by David Selby increases, this rise in asset value will be reflected in the net worth calculation. Conversely, a decrease in market value will negatively impact the net worth. Similarly, fluctuations in the value of stocks or other investments held by David Selby are directly reflected in the overall asset valuation and subsequent net worth calculation. Accurate valuation relies on employing appropriate methodologies and considering current market conditions. The complexity of valuation increases with the diversification and type of assets involved. For instance, a collection of rare books or art might require specialized appraisals beyond basic market research.

Understanding the connection between asset valuation and net worth is vital. A precise valuation process is essential for a true reflection of financial standing. Accurate asset valuations contribute to a clear understanding of an individual's financial health and provide a basis for informed decision-making. Challenges in asset valuation can lead to inaccurate or misleading estimations of net worth. These inaccuracies can have implications in various contexts, including financial planning, tax reporting, and investment strategies. Furthermore, a comprehensive approach to asset valuation, considering both tangible and intangible assets, is crucial for a complete and accurate picture of an individual's net worth, such as David Selby's.

4. Investment History

Investment history is a critical component in determining an individual's net worth. The decisions made regarding investments, both successful and unsuccessful, significantly influence the overall financial standing of someone like David Selby. Patterns and trends within investment activity can offer insight into financial strategies, risk tolerance, and the factors potentially impacting their accumulated wealth.

- Portfolio Composition

The types of investments held stocks, bonds, real estate, or other assets provide a snapshot of investment strategy. A diverse portfolio reflects a broader approach to risk management, potentially indicating a more stable financial foundation. Conversely, a heavily concentrated portfolio in specific sectors may point to a more speculative strategy and greater risk. Understanding the distribution of assets within David Selby's portfolio is crucial to assessing the potential impact on his net worth.

- Investment Timing and Strategy

The timing of investments and the overall investment strategy employed can reveal important details about the individual's financial approach. Successful investments made at opportune moments contribute positively to net worth. Conversely, poor timing or inappropriate strategies might have had the opposite effect. Analyzing the timing and strategy of investments helps gauge the potential future impact on David Selby's financial position.

- Returns on Investment

The performance of investments over time directly correlates with changes in net worth. Consistent positive returns on investments contribute to an increase in overall wealth. Substantial losses might indicate periods of financial downturn or ill-advised decisions. Understanding the returns generated from investments helps to determine the potential growth or decline in David Selby's net worth.

- Risk Tolerance and Diversification

The types of investments and the proportion allocated to each asset class showcase risk tolerance and diversification strategy. A high level of diversification suggests a calculated approach to risk management, potentially contributing to a more stable net worth. Conversely, a concentrated portfolio may indicate a higher-risk strategy with greater potential for volatility, which may affect future net worth projections.

In conclusion, a thorough analysis of investment history is vital in evaluating an individual's net worth. Understanding the portfolio composition, investment timing and strategy, returns on investment, and risk tolerance provides a clearer picture of the factors contributing to a person's overall financial situation. The interplay between these elements helps to illuminate the potential drivers of David Selby's net worth and how future investment strategies might influence it.

5. Income Sources

Income sources are fundamental to understanding an individual's net worth, like David Selby's. The nature and volume of income streams directly impact the accumulation and fluctuation of wealth. A thorough examination of income sources provides critical context for assessing the overall financial picture. The stability and predictability of income are key determinants of long-term financial security.

- Employment Income

Salaries, wages, and professional fees from employment represent a primary income stream. The type of employment, industry, and job position directly correlate to income levels. High-demand professions or executive roles often yield substantial salaries. Consistent employment and career advancement contribute significantly to sustained income and a positive impact on net worth.

- Investment Income

Returns from investments, such as dividends, interest, and capital gains, contribute to net worth. Successful investments and wise portfolio management generate passive income, augmenting overall financial standing. Investment income can play a crucial role in supplementing other income sources and contributing to wealth growth.

- Business Income

Entrepreneurial ventures or business ownership generate income from profits and revenue. The success and scale of the business operation are direct determinants of income levels. Business income can fluctuate significantly depending on market conditions and operational efficiency. A well-managed business serves as a significant source of wealth accumulation.

- Other Income Sources

Additional income streams include royalties, rental income from properties, and income from other sources specific to the individual. These supplemental income streams can significantly impact net worth, potentially adding stability or increasing the potential for growth. The significance of these sources depends on their consistent nature and overall contribution.

Analyzing income sources helps to understand the mechanisms by which an individual accumulates wealth. Understanding the diversification and stability of these sources is crucial for assessing the overall financial health and long-term trajectory of an individual's net worth, like David Selby's. Consistent and diverse income streams generally contribute to higher net worth potential. Fluctuations in income from different sources can influence the trajectory of net worth in both positive and negative directions.

6. Professional Success

Professional success often directly correlates with an individual's net worth. Career achievements, particularly in high-demand fields or entrepreneurial endeavors, frequently translate into substantial financial gains. This connection reflects the value placed on expertise, experience, and productivity within the marketplace.

- Income Generation

A high-paying profession or successful entrepreneurial ventures are significant drivers of income, directly contributing to the accumulation of wealth. Executive positions, specialized skills, or innovative business models often command premium compensation, accelerating the growth of an individual's net worth. The level of income directly impacts the potential for accumulating assets and reducing liabilities.

- Asset Acquisition

Career success often enables the acquisition of valuable assets. Financial resources accumulated through high-earning professions can be invested in real estate, stocks, bonds, or other investments. These assets, in turn, contribute to a higher net worth. Increased earning capacity facilitates the ability to acquire and build upon assets over time.

- Investment Opportunities

Professional success often unlocks investment opportunities. Experienced professionals, particularly in business or finance, may have access to unique investment opportunities or possess the expertise to navigate complex financial markets. The network and knowledge gained through successful careers can lead to advantageous investments, accelerating the growth of accumulated capital and thus enhancing net worth.

- Reduced Liabilities

A strong financial foundation arising from professional achievements can lead to reduced liabilities. High income often allows individuals to comfortably manage debts, potentially reducing the burden of loans and other financial obligations, ultimately enhancing their net worth figures. A well-established career can offer financial stability, minimizing reliance on borrowing.

In summary, professional success acts as a catalyst for building net worth. The interplay of higher incomes, asset accumulation, investment opportunities, and reduced liabilities all contribute to a strong positive correlation between professional achievement and financial standing. Understanding these factors can offer valuable insights into the trajectories of individuals like David Selby. Ultimately, professional success, in various forms, significantly impacts the overall net worth of an individual.

7. Net Worth Calculation

Determining net worth involves a systematic evaluation of an individual's financial position. This process is crucial for understanding an individual's overall financial standing, and for an individual like David Selby, it provides a framework for assessing their accumulated wealth. The calculation process considers various factors, allowing for a more comprehensive understanding of financial health.

- Asset Valuation

Accurate assessment of assets is fundamental. This includes tangible assets such as real estate, vehicles, and personal possessions. Intangible assets like stocks, bonds, and intellectual property are also factored in. Valuation methods vary depending on the asset type, with professional appraisals employed for complex items. The accuracy of asset valuation directly impacts the calculated net worth for individuals like David Selby.

- Liability Assessment

Accurately identifying and quantifying liabilities is equally important. Liabilities encompass debts, loans, and other financial obligations. Detailed records of outstanding payments and borrowed capital are essential for a precise calculation. This process, for individuals like David Selby, provides insight into the portion of assets committed to repayments or other debt obligations.

- Income Analysis

Examining income sources, both active and passive, is crucial. Analyzing salary, wages, investment returns, and other income streams contributes to the calculation. Understanding the composition and consistency of income is essential. For David Selby, this analysis could encompass income from employment, investments, and ventures. A comprehensive income analysis offers valuable insight into the wealth-generating capacity.

- Market Fluctuations and Impact

Market conditions and economic trends significantly affect asset values. For instance, stock market fluctuations directly impact investment holdings. Changes in real estate values also influence overall asset valuation. Understanding these market forces and their impact on assets is critical for an accurate and relevant net worth calculation. These factors influence the net worth of individuals like David Selby, making them dynamic figures rather than static ones.

In conclusion, a net worth calculation for an individual like David Selby provides a snapshot of their financial health at a specific point in time. By meticulously evaluating assets, liabilities, income, and market influences, a clear picture of financial position emerges. This methodology, while not providing a definitive measure of success, offers insight into the accumulation and management of wealth, potentially useful for various analyses.

Frequently Asked Questions about David Selby's Net Worth

This section addresses common inquiries regarding David Selby's financial standing. While precise figures are often unavailable, the following questions and answers provide context and insight into the factors contributing to financial estimations.

Question 1: How is net worth typically determined?

Net worth calculations assess total assets minus total liabilities. Assets encompass various holdings, including investments, real estate, and personal property. Liabilities represent debts, loans, and other financial obligations. The process involves detailed valuation of each asset and careful accounting of all debts.

Question 2: What sources of information are used to estimate an individual's net worth?

Publicly available sources, such as financial reports, news articles, and property records, often provide clues about an individual's financial situation. Industry publications, corporate filings, and historical data are frequently utilized, though full disclosure is not always available. The reliability of these estimates hinges on the accuracy and completeness of the information gathered.

Question 3: Why is accurate information on net worth sometimes unavailable?

Privacy concerns, avoidance of public disclosure, and the absence of mandatory financial reporting requirements often limit the availability of precise net worth figures. Complex financial structures and the dynamic nature of wealth accumulation can further complicate the estimation process. Not all individuals voluntarily disclose this information.

Question 4: How do market fluctuations affect estimates of net worth?

Market trends, particularly in real estate and financial markets, directly impact the value of assets. Changes in stock prices, real estate values, and other investment performance affect the overall net worth estimate. Estimates rely on valuations made at a specific point in time and are subject to potential fluctuations based on future market conditions.

Question 5: What are the limitations of publicly available data for determining net worth?

Public data often lacks the comprehensive detail necessary for precise calculations. Information can be incomplete, outdated, or potentially inaccurate. It's crucial to acknowledge these limitations when interpreting publicly available information concerning an individual's financial standing. Direct, verified financial records from the individual are preferred for a more accurate assessment.

In conclusion, estimating net worth necessitates careful analysis of available data, while acknowledging limitations. Publicly available information provides valuable context but is not a definitive measure of financial status. The process highlights the complexity of evaluating wealth, especially for private individuals.

Moving forward, exploring David Selby's background and career trajectory in greater depth will provide valuable context for understanding potential factors contributing to their financial situation.

Conclusion

Assessing David Selby's net worth necessitates careful consideration of various factors. Accurate determination relies on meticulous analysis of assets, liabilities, income sources, and investment history. While publicly available data offers a partial view, comprehensive financial disclosures are often unavailable. Market fluctuations and economic trends significantly impact asset valuations, rendering estimates dynamic rather than static. Key components in such analyses include professional success, which often correlates with substantial income generation and asset acquisition; diverse income streams, including employment, investments, and potentially business ventures; and the crucial evaluation of both tangible and intangible assets, along with liabilities. The process underscores the complexity of determining financial standing, particularly for individuals whose financial information remains largely undisclosed.

In conclusion, while a definitive figure for David Selby's net worth remains elusive without comprehensive financial disclosure, the exploration highlights the intricate interplay of professional achievements, economic factors, and individual financial decisions in shaping an individual's economic standing. Further research might uncover additional data points, allowing for a more complete and nuanced understanding. The analysis underscores the importance of complete financial transparency when evaluating an individual's net worth, and the limitations of relying solely on incomplete or potentially outdated public information.

You Might Also Like

Wesley Jonathan Net Worth 2023: A Look InsideJeff Fisher Net Worth: 2023 Update & Insights

Where Are Frank And Alana Logie Now? Their Latest Updates

Sullivan Sweeten Net Worth: 2023 Update & Details

Captain Sully's Net Worth: A Deep Dive Into His Finances

Article Recommendations

- Unveiling The Enigma Of Yuen Qiu A Journey Through Cinema

- Vedang Raina Parents

- Cancer Weekly Horoscope