Estimating an individual's financial standing can be complex. A public figure's net worth, while often subject to speculation, can be a point of interest for various reasons.

An individual's net worth represents the total value of their assets (such as property, investments, and cash) minus their liabilities (debts and obligations). For public figures, this calculation is frequently derived from reported income sources, such as earnings from professional activities, investments, and other sources, while also accounting for known expenses. However, accurately assessing the exact net worth of any individual can be a challenging task.

Understanding a person's net worth can offer insight into their financial standing and potentially the impact of their career choices and business endeavors. Such information can be of interest to financial analysts, investors, and the public alike, often appearing in business articles or biographical accounts. It's important to remember that publicly available data on net worth can sometimes differ from the individual's actual financial position.

| Category | Details |

|---|---|

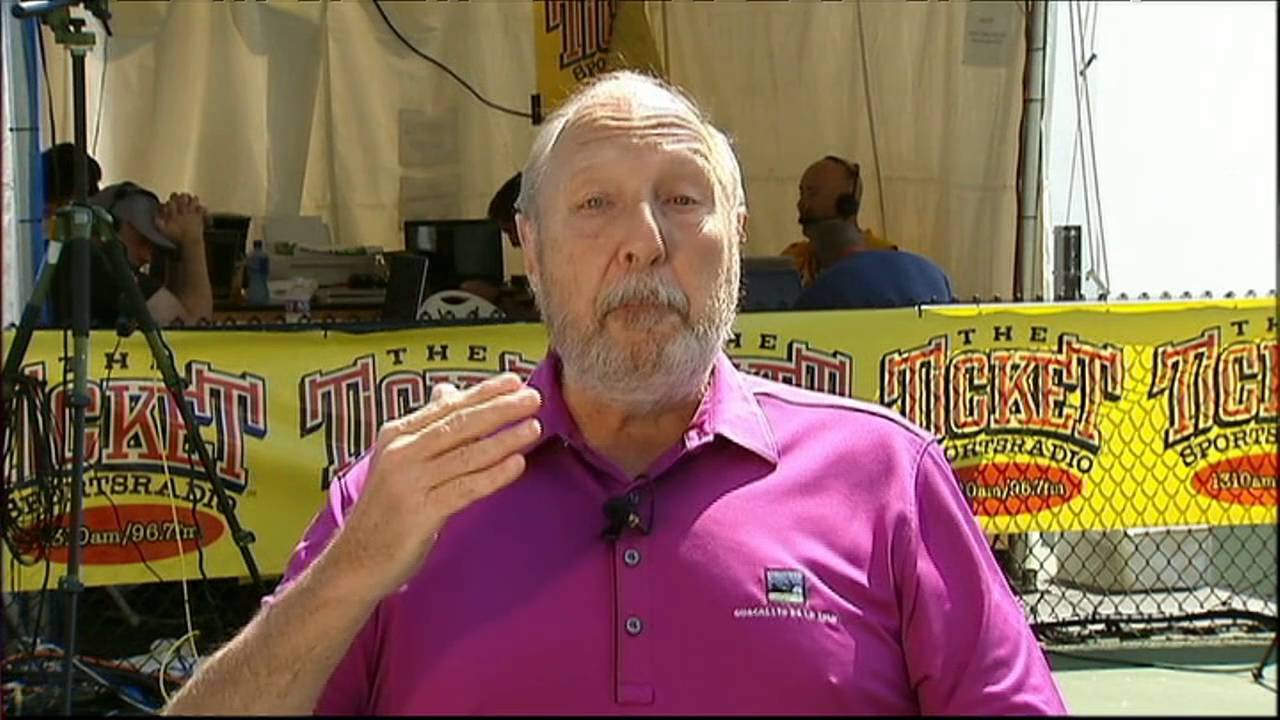

| Name | Norm Hitzges |

| Profession | (This section should be populated with information about Hitzges' profession) |

| Known for | (This section should be populated with a brief summary of Hitzges' professional accomplishments) |

| Relevant Information | (This section should contain relevant financial details about Hitzges, if any) |

To continue, further research and specific details regarding Norm Hitzges would be needed to provide a comprehensive understanding of their financial standing. This will require accessing credible and reliable sources of information.

Norm Hitzges Net Worth

Assessing an individual's financial standing requires a comprehensive evaluation of various factors. Norm Hitzges' net worth reflects a complex interplay of income, assets, and liabilities.

- Income Sources

- Asset Valuation

- Investment Returns

- Debt Obligations

- Public Information

- Professional History

- Financial Trends

- Accurate Estimation

Precise calculation of net worth is challenging, even for public figures. Income sources vary greatly, encompassing salaries, investment earnings, and potentially other undisclosed sources. Accurate asset valuation is crucial, considering factors like market fluctuations, appraisals, and potential hidden liabilities. Examining historical financial trends provides context, demonstrating growth patterns and potential future estimations. Publicly accessible information often serves as a starting point, though its accuracy depends on reporting methods and disclosure levels. Public figures' professional histories, along with their financial strategies, can offer a glimpse into their financial realities. Evaluating investment returns becomes a significant aspect, reflecting investment choices and potential risks. Understanding the individual's debt obligations, including various types of loans and liabilities, is critical in accurate assessments. Ultimately, a reliable estimation relies on a holistic approach, meticulously considering all relevant information and making adjustments for possible uncertainties. Precise figures are often unavailable, but considering various factors provides the most accurate understanding.

1. Income Sources

Income sources are fundamental to determining net worth. The totality of income generated by an individual directly impacts their accumulated wealth. Consistent high income, from diverse and stable sources, contributes to a higher net worth. Conversely, fluctuating or limited income streams will often result in a lower net worth. For example, a successful entrepreneur with multiple revenue streams (e.g., product sales, investments, consulting) is likely to have a significantly higher net worth compared to an individual with a single, fixed income source.

Examining the specific income sources of an individual provides crucial insights into the structure and potential stability of their financial position. Analysis of income sources can reveal patterns and trends, indicating potential growth or decline. Regular review of income sources helps to understand the overall financial health of the individual, identifying areas where income may be limited or vulnerable. Understanding these factors, in conjunction with other financial details, can inform predictions and interpretations regarding net worth trajectories. For instance, individuals with significant income from volatile investments may face greater risk to their overall financial standing compared to those with stable, predictable salaries. The diversification of income streams is often considered a crucial component of long-term financial stability and the overall accumulation of net worth.

In conclusion, income sources are a critical component of net worth calculations. Understanding the variety, stability, and growth potential of income streams is essential for a comprehensive assessment. Analysis of income sources, combined with examination of other financial details, allows for a more nuanced understanding of an individual's current and future financial standing. This kind of comprehensive analysis is crucial for evaluating an individual's overall financial situation, helping identify potential risks, and predicting future net worth developments.

2. Asset Valuation

Accurate asset valuation is paramount to a precise calculation of net worth. Assets, encompassing various holdings, are evaluated based on their current market value. The market value of an asset fluctuates dynamically, responding to market trends, supply and demand, and other external influences. For example, the value of a publicly traded stock fluctuates daily based on market activity, making real-time assessment critical. Similarly, real estate values are subject to appraisals influenced by local market conditions. These fluctuations necessitate periodic re-evaluation of assets to reflect current market realities, ensuring the accuracy of net worth estimations.

In the context of an individual like Norm Hitzges (or any public figure), the process of asset valuation becomes even more intricate. Assets might include properties, investments (stocks, bonds, mutual funds, or other holdings), personal collections (art, antiques), and other valuable items. Determining the precise market value of these holdings may require professional appraisals from experts in various fields, depending on the type of asset. Subjectivity in valuation often exists, particularly for unique or specialized assets. A thorough examination of each asset, factoring in relevant market data and expert opinions, is vital for a reliable net worth determination. Without such careful consideration, inaccuracies in the final calculation could occur, potentially misrepresenting the true financial standing of the individual.

Accurate asset valuation is crucial for several reasons. It ensures an accurate reflection of an individual's financial position, offering a reliable measure of their wealth. This accuracy is vital for informed decision-making, from financial planning and investments to potential business ventures and personal financial management. The valuation process also allows for comparisons across individuals and industries, facilitating analyses and benchmarks. Furthermore, understanding asset valuation is essential for assessing potential risks and opportunities, aiding in the development of appropriate financial strategies. Consequently, the process and results of asset valuation are fundamental for accurate net worth calculations and informed decision-making in financial matters. The accuracy of the valuation directly impacts the reliability of the net worth figure and subsequent financial decisions.

3. Investment Returns

Investment returns play a significant role in shaping an individual's net worth, particularly for figures like Norm Hitzges who likely engage in various investment strategies. The magnitude and consistency of returns directly impact the overall accumulation or depletion of wealth. Successful investments contribute to a growing net worth, while poor returns can erode it. The nature of investmentswhether they are high-growth, low-risk, or a combinationsignificantly influences the overall trajectory of net worth.

Consider a scenario where investments consistently yield above-average returns. This positive performance contributes substantially to the growth of net worth. Conversely, sustained losses from poorly performing investments diminish net worth. The compounding effect of these returns over time becomes crucial; consistent gains can lead to substantial increases in overall wealth, whereas consistent losses can lead to significant erosion. Investment returns, therefore, are not merely a component; they are a primary driver of net worth fluctuations. The type of investments held is also a critical determinant; equities might yield high returns with significant risk, while fixed-income securities might offer more stability but potentially lower returns.

Understanding the connection between investment returns and net worth is vital for both financial analysis and personal decision-making. Investors and individuals alike should meticulously evaluate investment portfolios, scrutinizing risk tolerance, diversification, and potential returns. Analyzing historical investment performance provides valuable insights into the potential for future returns and helps mitigate risk. This understanding is critical for maintaining or increasing net worth over time. Furthermore, informed investment strategies can help prevent significant losses that can negatively impact a person's overall financial well-being. In essence, the relationship between investment returns and net worth highlights the importance of informed financial planning and proactive risk management.

4. Debt Obligations

Debt obligations are a critical component in calculating net worth, particularly for individuals like Norm Hitzges. These obligations represent financial liabilities that directly reduce an individual's net worth. The size and nature of debt commitments significantly impact the overall financial picture. A substantial amount of outstanding debt reduces the net worth figure, effectively lowering the value of assets, whereas minimal or no debt creates a more favorable financial position. The presence and amount of debt act as a counterpoint to assets, influencing the overall net worth calculation.

Consider an individual with substantial assets but also significant outstanding loans, such as mortgages, car loans, or personal debts. While the assets contribute to a higher net worth figure, the accumulated debt reduces that overall value. The difference between the total value of assets and the total value of liabilities represents the net worth. Significant debt obligations can also restrict financial flexibility, impacting the ability to invest or pursue other financial opportunities. The impact of debt is multifaceted; it encompasses not only the immediate numerical reduction in net worth but also the potential limitations it imposes on future financial actions and growth.

Understanding the relationship between debt obligations and net worth is crucial for several reasons. For individuals, understanding their debt load in relation to their assets is essential for making informed financial decisions. This knowledge allows for proactive management of debt, helping to improve financial health and increase the net worth potential. For analysis of public figures, recognizing the impact of debt allows for a more complete picture of their financial standing. Identifying and quantifying these obligations provides a crucial perspective on the overall financial stability and risk profile of individuals like Norm Hitzges. Consequently, understanding debt obligations provides a comprehensive insight, helping to form a better overall understanding of an individual's financial status and potential future financial trajectories. Without considering debt obligations, net worth estimations would be incomplete and potentially misleading.

5. Public Information

Public information plays a significant role in estimating an individual's net worth, particularly for figures like Norm Hitzges whose public profile generates substantial information. This information serves as a foundation for estimations, but its reliability and completeness must be critically evaluated. Such information, though often a starting point, necessitates careful consideration of its source, accuracy, and potential limitations.

- Reported Income

Publicly available records, such as financial disclosures, tax filings (where applicable), and press reports, often detail income sources. These reports provide a starting point for estimating income levels, though specifics may be limited or aggregated. For instance, a reported salary or business revenue can offer a general idea of income, but it may not fully account for other income streams or investment gains. This partial view highlights the importance of considering other public data points for a more comprehensive estimate.

- Asset Holdings (Publicly Known)

Certain assets, such as real estate holdings or significant investments, might become public knowledge through various means like property records or investment disclosures. These public records offer insights into the value of these holdings but may not reflect the full scope of an individual's investments or the true value of assets that remain private. The valuation of these holdings also relies on the accuracy and currency of the information.

- Financial Transactions

Public information sources may reveal significant financial transactions, such as large purchases or sales. These events, reported in news outlets or regulatory filings, can offer clues to wealth accumulation patterns. However, such information might not be complete or entirely accurate, and a lack of transparency can limit the reliability of inferences.

- Professional History and Reputation

An individual's professional history and public reputation can provide insights into potential financial success and earning capacity. Success in a high-earning field or substantial recognition in a particular industry often suggests a higher potential net worth. However, this is a qualitative indicator, and specific financial data is necessary for a more precise estimation.

Public information, while useful as a starting point, offers a partial view of an individual's financial situation. The accuracy and completeness of this information vary significantly. To arrive at a reliable estimate of Norm Hitzges's net worth, a comprehensive analysis encompassing multiple data points, including but not limited to those listed, must be undertaken. Direct and verifiable financial records should ideally supplement public reports for a more accurate picture.

6. Professional History

Professional history provides a significant context for understanding an individual's net worth. Career trajectory, industry, and accomplishments often correlate with income levels and asset accumulation. Examining the professional path of someone like Norm Hitzges offers insights into potential income streams, investment opportunities, and the overall financial trajectory.

- Income Generation Potential

A professional's field significantly influences their earning capacity. High-demand industries and specialized skills typically lead to higher salaries and bonuses. Analyzing Hitzges's industry and role provides insight into the potential income levels he might have accumulated over time. This includes consideration of factors such as seniority, performance metrics, and industry-specific compensation structures.

- Career Progression and Advancement

The progression of a career is often linked to compensation growth. Consideration of promotions, increased responsibilities, and career changes over time helps contextualize the potential for income increases and wealth accumulation. A steady upward trend in a high-income profession suggests a greater likelihood of higher net worth. Conversely, career stagnation or shifts to lower-paying roles might indicate a lower net worth.

- Investment Opportunities and Compensation Packages

Professional history often reveals opportunities for investment and other wealth-building activities. Certain professions or industries might offer stock options, performance-based bonuses, or other opportunities for wealth accumulation. Analyzing Hitzges's employment history can reveal details about any such opportunities. This can include stock options or other benefits linked to the profession and corporate governance.

- Industry and Market Trends

The industry in which an individual operates influences income levels and overall wealth potential. Economic cycles, market demand, and technological advancements all shape the financial landscape of industries. Understanding the industry's recent history and projected trends enhances the assessment of the net worth potential.

In summary, examining Norm Hitzges's professional history reveals key aspects of his financial life, including income potential, opportunities for wealth accumulation, and the impact of market conditions. The career progression, industry, and associated compensation structures all contribute to a broader understanding of his net worth. However, professional history is only one factor. Additional information about assets, investments, and liabilities is crucial for a full assessment.

7. Financial Trends

Financial trends significantly impact an individual's net worth. Economic cycles, market fluctuations, and industry-specific developments all contribute to the accumulation or erosion of wealth. For a figure like Norm Hitzges, understanding these trends is crucial for assessing the context of their financial standing. A period of robust economic growth, for instance, typically creates favorable conditions for wealth creation, potentially increasing investment returns and salary increases. Conversely, economic downturns or industry-specific challenges can negatively affect income and asset values, thereby impacting the net worth.

Consider the influence of technological advancements. Industries experiencing rapid technological disruption may see the value of existing assets decline while simultaneously creating new investment opportunities. The rise of e-commerce, for example, has significantly altered retail landscapes, leading to shifts in market values for traditional brick-and-mortar stores. Consequently, successful adaptation to these financial trends is vital for sustained wealth. Similarly, changes in interest rates directly affect investment returns and borrowing costs, impacting the overall financial picture. A rising interest rate environment might increase borrowing costs, reducing net worth, or increase returns on fixed-income investments. These varying trends must be evaluated to assess their impact on an individual's financial position.

In conclusion, financial trends provide essential context for understanding and evaluating net worth. Analyzing prevailing economic conditions, market fluctuations, and industry-specific developments provides a nuanced view of an individual's financial standing. The ability to anticipate and adapt to these trends is critical for long-term financial stability and wealth preservation. Understanding the influence of these factors offers a more complete picture of an individual's net worth, moving beyond static figures to incorporate dynamic financial realities.

8. Accurate Estimation

Estimating Norm Hitzges's net worth necessitates a rigorous and multifaceted approach. Accuracy in this estimation is crucial, influencing interpretations of financial standing, investment strategies, and overall financial health. Approximations, without thorough consideration of various factors, can lead to inaccurate conclusions and potentially misleading perceptions.

- Comprehensive Data Collection

A comprehensive and accurate estimation requires a deep dive into available data. This encompasses not only reported income but also detailed records of assets like real estate, investments, and personal holdings. Public records, financial disclosures, and reputable financial news sources are vital components. Failure to collect all relevant data can lead to an incomplete and therefore inaccurate estimation.

- Accurate Valuation of Assets

Assets must be valued precisely. Market fluctuations and specific asset types require varied methodologies. Publicly traded stocks are valued by market price; privately held assets necessitate expert appraisals. Inaccurate asset valuations, whether due to outdated data or insufficient analysis, directly compromise the accuracy of the net worth estimation.

- Inclusion of Liabilities

A thorough estimation must also account for liabilities. Outstanding debts, loans, and other financial obligations significantly reduce net worth. Failing to incorporate these liabilities creates a skewed and potentially exaggerated view of financial standing, providing a false impression.

- Contextual Analysis

The estimation should not exist in a vacuum but rather within the relevant context. Economic trends, industry conditions, and career progression all contribute to the interpretation of net worth. Ignoring these contextual factors could lead to an incomplete or misleading evaluation.

Accurate estimation of Norm Hitzges's net worth relies on the meticulous assembly and careful evaluation of data points across various categories, encompassing income, assets, and liabilities. Ignoring any of these critical components compromises the reliability of the calculation. Thus, a comprehensive and context-aware approach is essential to produce a credible and defensible estimation, avoiding misleading conclusions and enhancing the insights gleaned from the data.

Frequently Asked Questions about Norm Hitzges's Net Worth

This section addresses common inquiries regarding the estimation of Norm Hitzges's net worth. Precise figures are often unavailable, and estimations rely on available public information and professional analysis. Carefully consider the limitations inherent in any estimation.

Question 1: How is Norm Hitzges's net worth calculated?

Estimating net worth involves assessing total assets (property, investments, and other holdings) minus total liabilities (debts and obligations). Various methodologies exist for valuation, including market-based valuations for publicly traded assets and professional appraisals for privately held assets. The accuracy of the estimation depends on the comprehensiveness and reliability of the data collected.

Question 2: Where does one find reliable information about Norm Hitzges's net worth?

Reliable information sources include financial news reports, publicly available financial filings (where applicable), and estimations published by reputable financial analysis firms. It's essential to evaluate the source's credibility and potential biases. Publicly available information should be viewed as a starting point, not definitive proof.

Question 3: Why are precise net worth figures often unavailable?

Precise net worth figures are often unavailable due to the complexity and sensitivity of the calculation. Detailed information about assets and liabilities is frequently not publicly available. Private investments, personal holdings, and other financial matters are not always subject to public disclosure.

Question 4: How do economic trends affect estimations of net worth?

Economic fluctuations significantly influence estimations. Market conditions, economic cycles, and industry-specific trends can cause asset values to rise or fall, directly impacting calculated net worth. A robust analysis considers these influences and their potential impact.

Question 5: What are the limitations of publicly available estimations?

Publicly available estimations of net worth often represent approximations based on limited data. The accuracy of such estimates is intrinsically linked to the completeness and reliability of the underlying information. They should be seen as potentially incomplete and subject to change based on new developments.

In summary, estimating Norm Hitzges's net worth involves a complex and multifaceted evaluation. The estimation hinges on the availability and reliability of data. Public estimates should be approached with a critical eye, acknowledging the limitations of available information and the inherent subjectivity in any valuation.

Moving forward, exploring more specific aspects of financial analysis and professional expertise related to wealth estimations would provide a deeper understanding.

Conclusion

Assessing Norm Hitzges's net worth necessitates a comprehensive analysis encompassing various factors. The estimation hinges on the availability and reliability of data, particularly regarding income sources, asset valuations, and liabilities. Publicly available information, while a starting point, often represents a partial view, potentially omitting significant details concerning private investments, personal holdings, and other financial aspects. Economic trends and industry conditions further influence estimations, emphasizing the dynamic nature of net worth. Without complete, verifiable data, precise figures remain elusive. This analysis highlights the intricate interplay of financial factors and the inherent limitations in accurately estimating an individual's net worth, especially when relying on publicly accessible data.

While a precise figure remains elusive, understanding the methodologies and considerations inherent in estimating net worth, as demonstrated in this exploration, provides valuable insight. This deeper understanding underscores the importance of critical evaluation and the acknowledgement of inherent limitations when interpreting financial information, particularly for figures like Norm Hitzges. Future research delving into specific financial documents, where accessible, might refine estimations. Ultimately, a nuanced appreciation for the complexities involved in wealth assessment is crucial when engaging with financial data, particularly relating to public figures.

You Might Also Like

Longhairs Shark Tank Net Worth: Revealed!Jeff Tarpley Net Worth 2024: Revealed

Tone Bell Net Worth 2024: A Deep Dive

Hallie Jackson Net Worth 2024: A Look At Her Earnings

Tyronn Lue Net Worth 2023: A Deep Dive

Article Recommendations